“When will mortgage rates go down?” It’s a question on the minds of many potential homebuyers, and for a good reason. Low mortgage rates can make the difference between a budget-friendly monthly payment and one that breaks the bank. But unfortunately, there’s no surefire way to predict when rates will drop.

As someone who has worked in the mortgage industry for over 20 years, attempting to guess where interest rates will go is a fool’s errand. Rates can fluctuate in any direction, and many factors can influence their movement, including the state of the economy, inflation, and even global events.

How are mortgage rates determined?

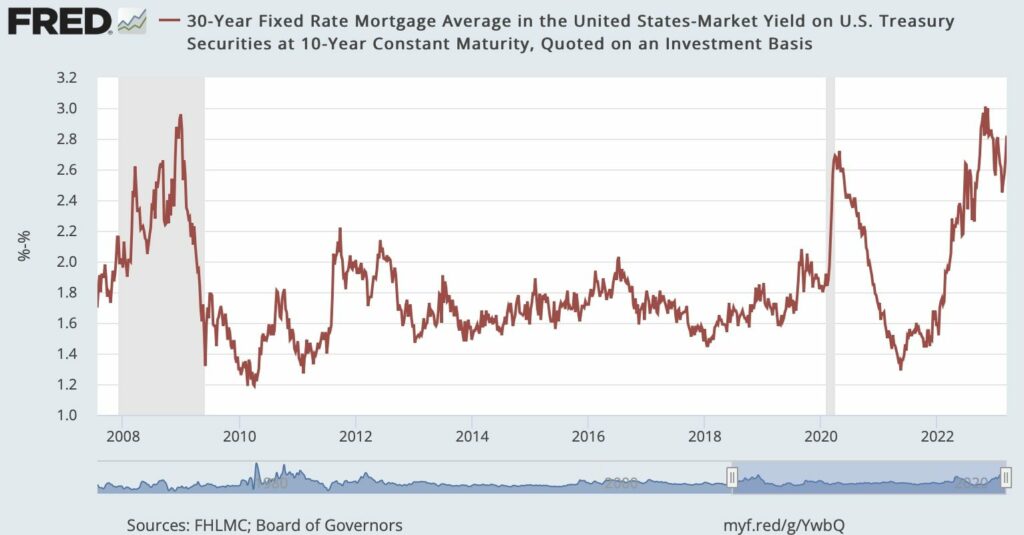

Mortgage rates are often closely tied to the yield on the 10-year Treasury note, which is considered a benchmark for the long-term interest rates that drive the housing market. However, there is a spread between the yield on the 10-year Treasury and the mortgage-backed securities (MBS) used to fund home loans. This spread, known as the “MBS spread,” reflects the additional risk investors take when purchasing MBS instead of the more liquid and secure Treasury notes. The MBS spread can fluctuate based on various factors, including the overall demand for mortgage-backed securities and the perceived risk of the underlying mortgages.

The interest rate is not the only thing that determines the affordability of a home. House prices can also fluctuate, affecting how much you’ll need to borrow and at what rate. As a result, it’s common to see swings in the housing market that can make homes more or less affordable over time.

When is a good time to jump in?

So, what’s a potential homebuyer to do? The best approach is to focus on what you can control. Instead of guessing when mortgage rates will go up or down, focus on finding a home that fits your budget and makes financial sense for you. That means waiting for the right opportunity rather than rushing into a purchase because rates are currently low.

It’s important to remember that everyone’s financial situation is unique, and what may make sense for one person may not be the right choice for another. However, if you are currently paying close to what you would spend on a mortgage in rent, it may be a good time to consider purchasing a property. It’s always a good idea to consult a financial advisor or mortgage lender to help determine what is best for your situation. You can also use an app like Confer Today to compare interest rates between different lenders. Ultimately, the key is finding a home that fits your budget and makes financial sense for you, regardless of the current state of the housing market and interest rates.

Achieving the American Dream of Home Ownership.

Ultimately, the most important thing is finding a home you love and can afford. So refrain from letting the ups and downs of the housing market and rate hikes dictate your home-buying decisions. Instead, take a long-term view and ensure that the numbers make sense for you and your family. Achieving the American Dream of Home Ownership is possible by buying a home that will bring you joy and stability for years to come. Confer is here to help you along the way and make sure that you get the best interest rate possible for your new home.