Our tools ARE simple to use

Next-Gen Software tools for the modern Lender

We are a cloud-first bespoke software development fintech startup specializing in mortgage finance. Whether you need to streamline your operations, improve the customer experience, or optimize your financial processes, we have the expertise and experience to deliver results.

Improved Customer Experience

Personalize the CX

Provide offers and recommendations relevant to your borrower’s unique financial need.

Empower your employees

Institutionalize the knowledge that the best salespeople have by providing AI tools at their fingertips

Use Tech to Impress

AI and machine learning are tailor-made for unique and personalized CX experiences.

Manage Your Mortgage Toolkit with Confer

Built by industry leaders with decades of mortgage finance expertise, our technology solutions will truly deliver an outstanding experience for your customers, vendors, and employees. Additionally, in this ever-changing industry, we strive to provide your company with the utmost speed to market.

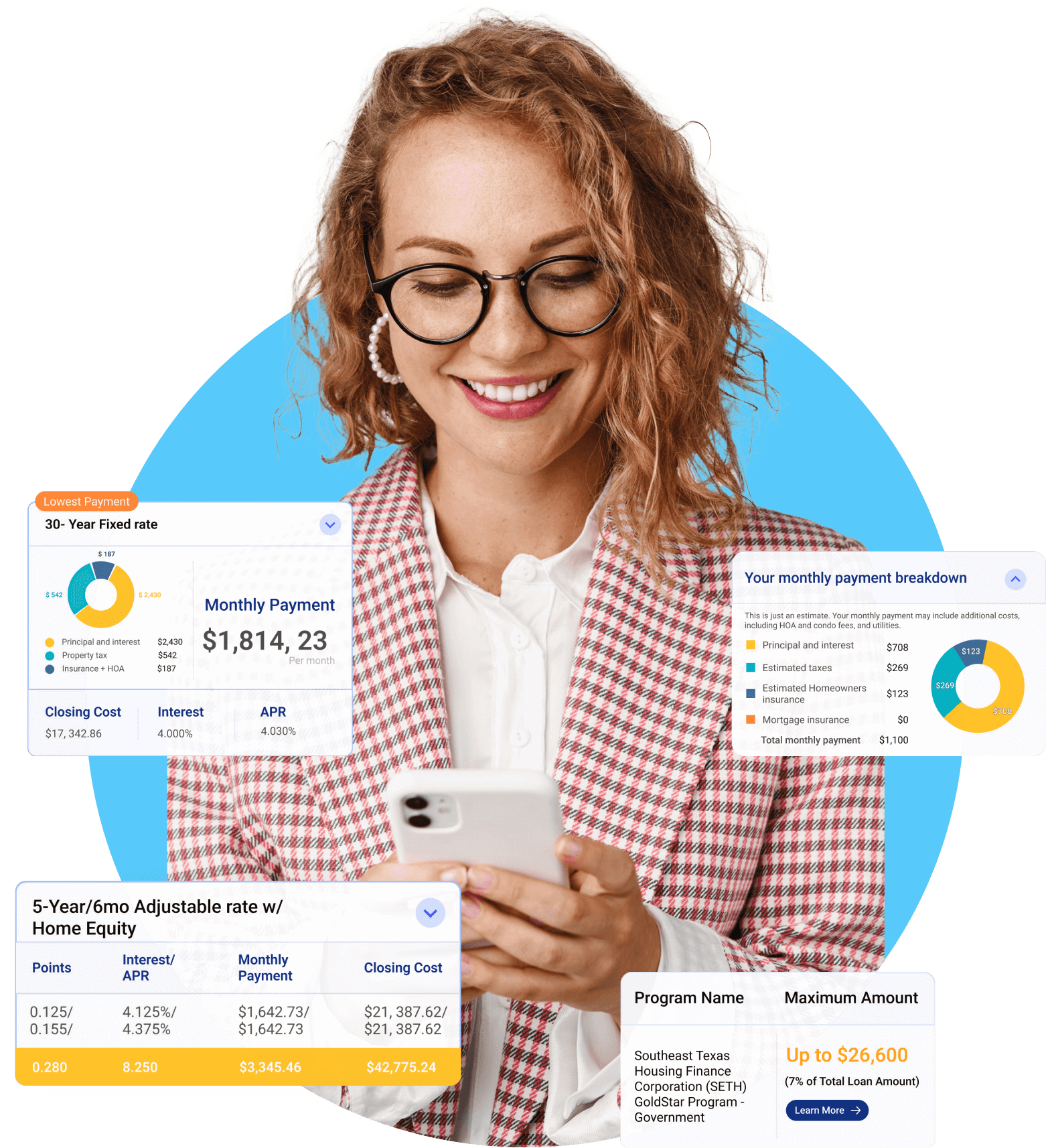

Competitive Offers Matching Tool

AI that will find mortgage products/programs from your offerings that will beat the competitors offer.

Recommendations Tool

Help your borrowers find the best rates & programs for them and compare their options.

Refinance Calculator

Comparing existing and refinanced loans side by side.

Affordability Calculator

(DAPs) Calculator

Find out if they qualify for Down Payment Assistance.

Home Equity Line of Credit Payment Calculator

Competitive Offers

Matching Tool

AI that will find mortgage products & programs from your product suite that will beat the competitor’s offer. Institutionalize the knowledge that the best salespeople have.

Upload or take a picture of the Loan Estimate from a competitor and let our AI find mortgage product & program combinations from your offerings that will beat the competitor’s offer. We help borrowers compare up to three scenarios side-by-side to understand why your offer is the best offer.

Recommendations Tool

We all know that buying a house is one of the biggest financial transactions of their life for most.

The good news: Our recommendations tool can tell you what kind of loan would be best suited for them based on their unique financial scenario. We provide actionable insights that help them save thousands. We compare different product products & programs to find financially beneficial products. Compare various product types, Conf, NonConf, HiBal, and different MI types SPBMI, LPMI, FHA, etc.

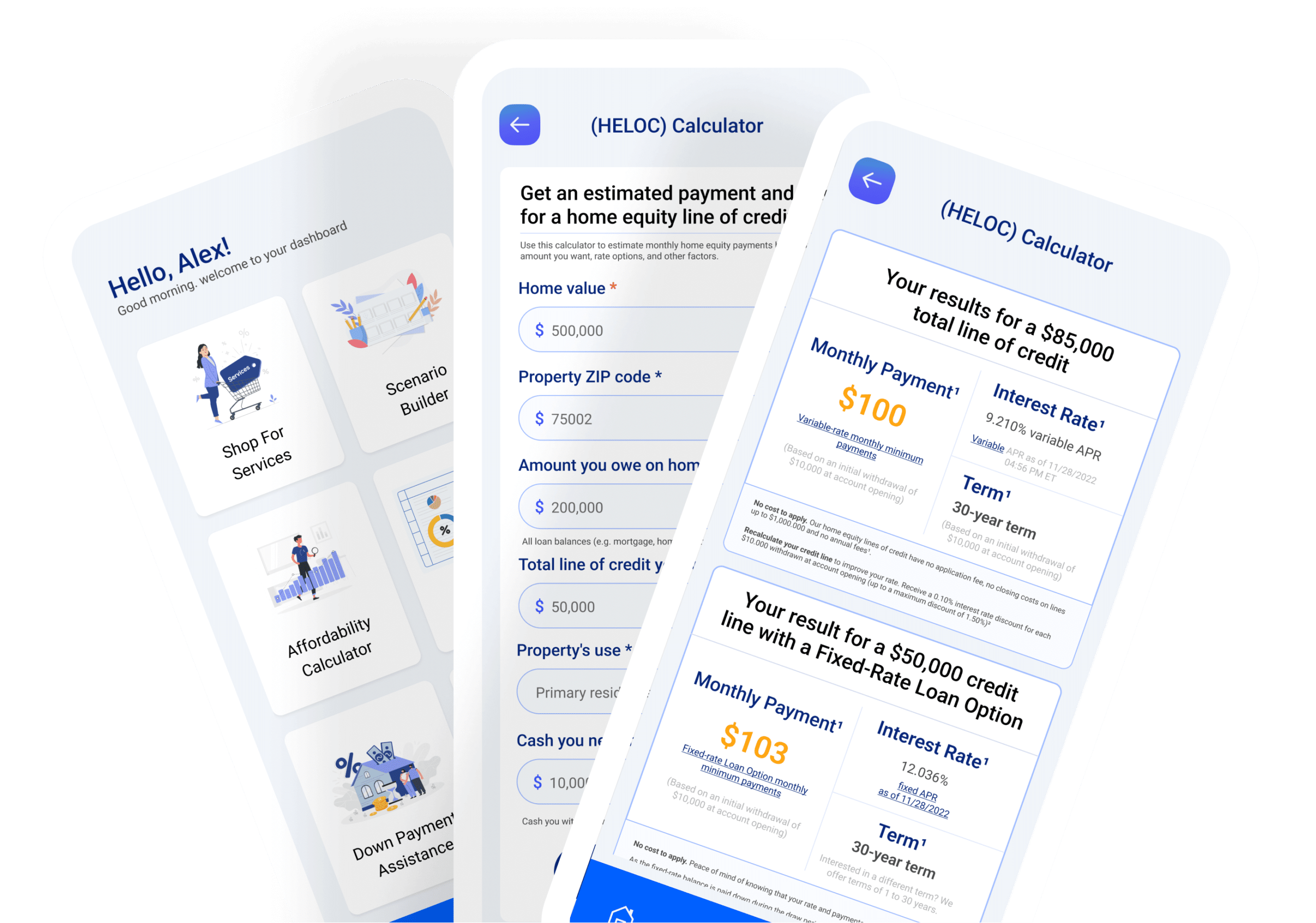

Refinance Calculator

Whether it be to consolidate debt, make home improvements, or access home equity for other purposes, find out what is the best product.

Either connect your financial account to access your mortgage statement or upload a mortgage statement by simply taking a picture and letting our tool extract all the relevant information to find the best product. Compare Home Equity vs. cash-out refi, HELOC, HE Loan, FRA, & rate reduction Refinance.

Affordability Calculator

Buying a house is an expensive purchase with rates on the move; help them find out how much home they can afford.

Help them find out how much house they can afford based on their income, current rates, and current credit policy, and calculate their monthly payments to determine their price range and home loan options so that they can be confident in planning for the most significant financial decision of their life.

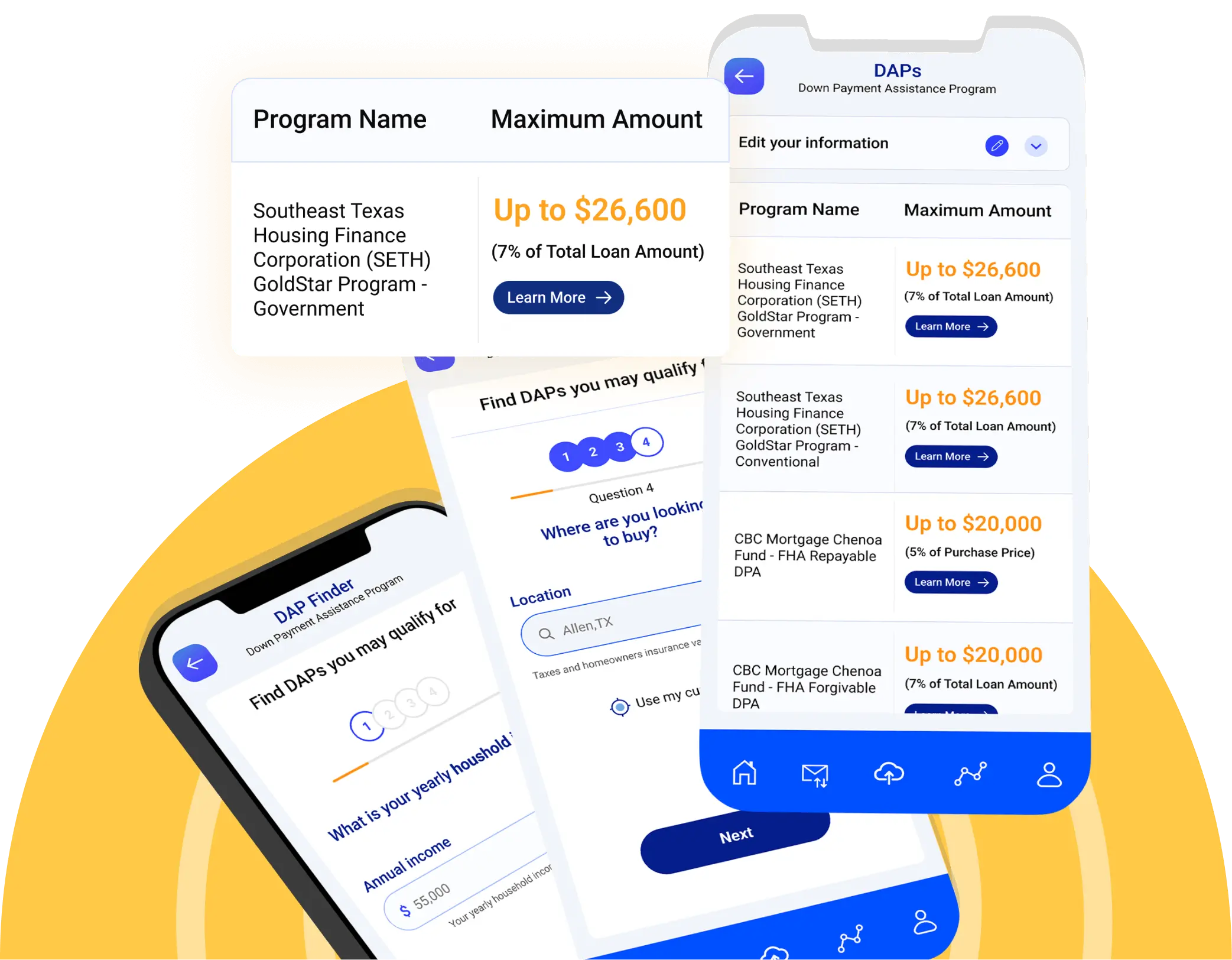

Down Payment Assistance Programs (DAPs) Calculator

Won’t it be great if they had a helping hand with their most expensive purchase?

Down Payment Assistance (DAP) makes it easier to afford a home. DAP comes from grants or loans from various local and federal agencies. The good news: We do the heavy lifting by scouring through the internet and reliable local agency publications to find Down payment assistance programs they might qualify for.

Home Equity Line of Credit Payment Calculator

To find out if HELOC is advantageous Vs. Cash-Out Refinance.

Get an estimated monthly payment and rate for a home equity line of credit, home equity loan, or fixed-rate advance with our HELOC calculator.

We are a cloud-first bespoke software development fintech startup specializing in mortgages. We have the expertise and experience to deliver results.

Copyright © 2023 | All Rights Reserved Confer Inc