If you’re a lender looking to increase profitability, improve operational efficiency, and manage risk in a rapidly changing financial landscape, experience the power of modern fintech with Confer.

Our modular design allows you to choose either a single tool or our entire suite of tools to integrate with your existing platform.

You can choose from our suite of services to complement your current processes.

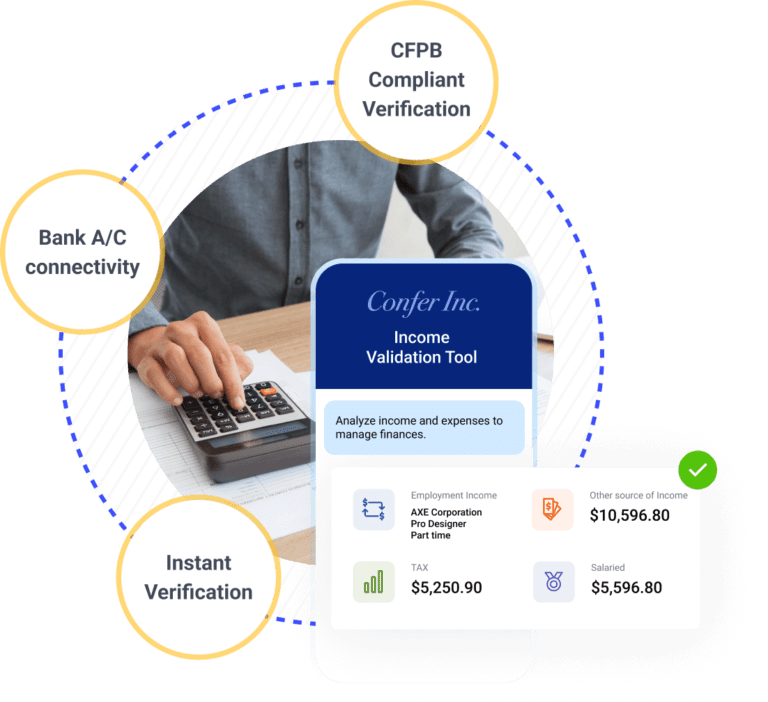

Our Income ValidationTool verifies borrower income in accordance with underwriting guidelines, saving you time and reducing risk.

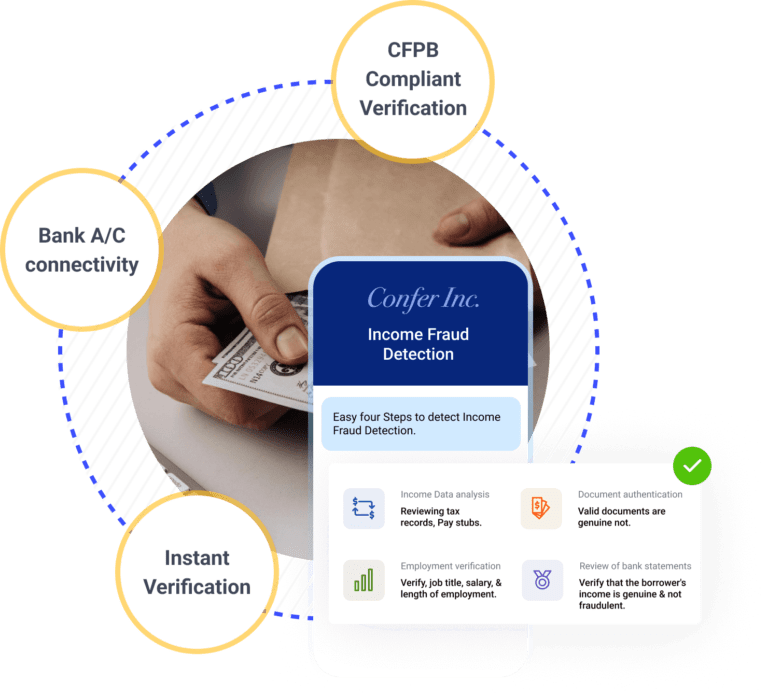

Identify & prevent fraudulent activity related to the reporting or misrepresentation of income.

Accurately calculate and disclose the fees associated with originating a mortgage loan. Ensure compliance with regulatory requirements and provide transparency to borrowers.

Streamline your procurement process, reduce costs, and ensure that they receive the products or services they need promptly and efficiently.

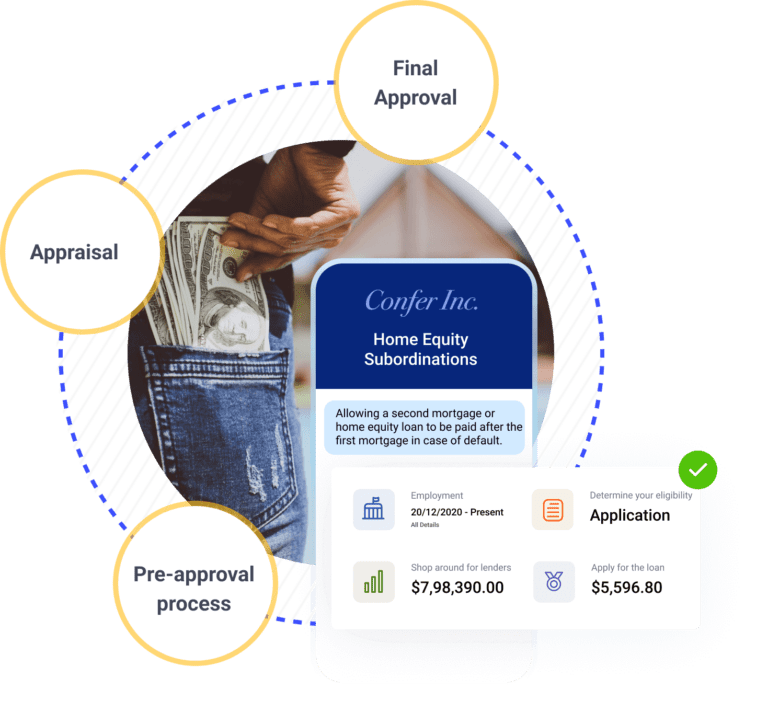

Save homeowners time and hassle and help them to move forward with their mortgage or refinance more quickly.

We specialize in creating bespoke software solutions that help banks to deliver a seamless and personalized experience to their customers.

Our solutions are designed to streamline processes, increase efficiency, & provide users with the convenience and control they demand.

Whether through automation, data analytics, or process optimization, we have the tools & expertise to help you improve efficiency.

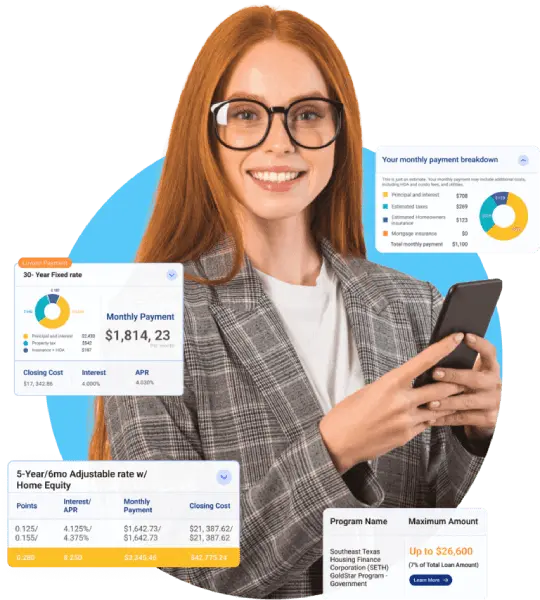

With the help of Confer’s tools and services, you can seamlessly streamline the customer journey to homeownership with an omnichannel approach to originations.

Use our cutting-edge tools to simplify the application process. We provide an easy-to-use online application platform and clear communication about the required documentation and steps. And separate yourself from the crowd by giving personalized advice and support to help customers make informed decisions and stay on track to achieving the dream of homeownership.

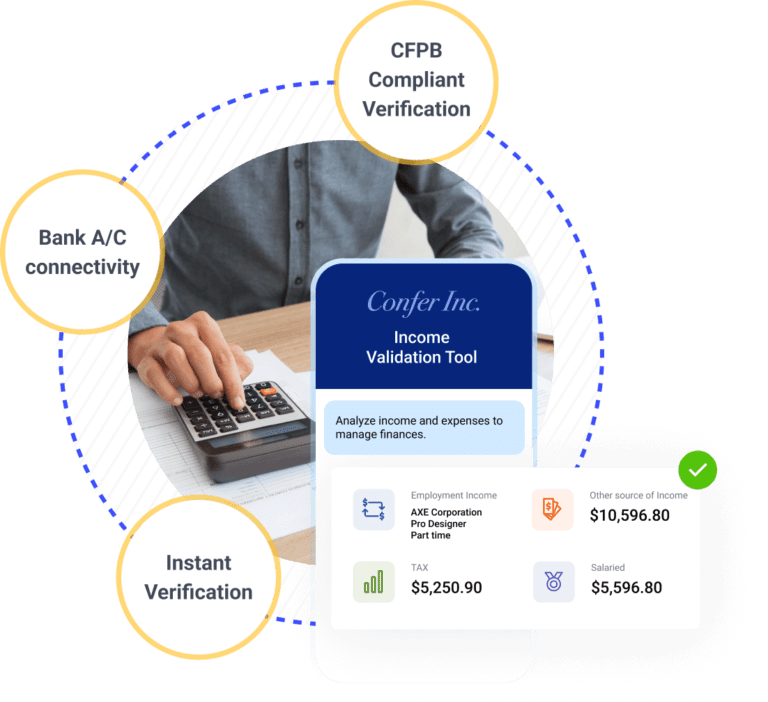

Income verification can be laborious and prone to errors, posing compliance risks. Our Income Analysis Tool automates and streamlines this process. It offers instant income verification and connects with bank accounts through Plaid for quick, accurate results. More than a simple income verifier, it ensures CFPB compliance, reducing your regulatory burden.

Lenders using our tool have significantly reduced errors and saved valuable time. Ready to simplify your income verification process?

An effective practice to detect and prevent fraud demands the use of multiple analytics and machine learning techniques.

We provide cutting-edge technology solutions to help banks and lenders with their Loan Estimate and Closing Disclosure data accuracy needs. We know how important it is to put the best foot forward with an accurate Loan Estimate the first time, reducing Over Tolerance losses and CCV tasks to monitor. We have nationwide fee data for various services, and we continue adding more every week. We take pride in delivering exceptional speed and accuracy. Our results are always TRID compliant and guaranteed to prevent costly fee refunds. You can use our Cloud-based custom fee-engine technology as a standalone application or directly integrate it within your LOS.

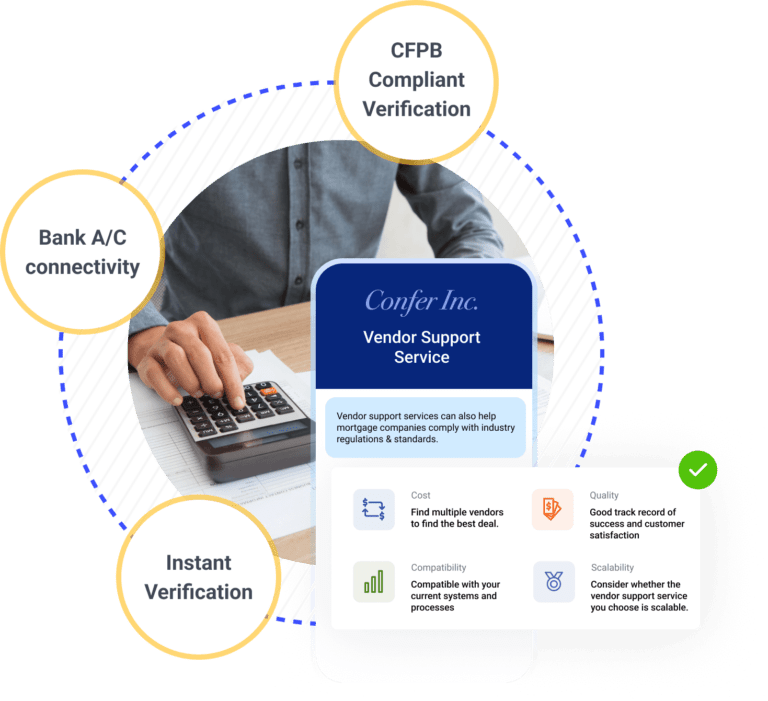

Let us help you place, follow up on, and expedite orders with your vendors. All while reducing your cost of origination by only paying for successful orders. We have resident knowledge of the best way to connect with vendors nationwide. This also reduces turnaround time for most.

A subordination agreement is an agreement with any second mortgage, HELOC, or other lien holders to subordinate their debt to the primary mortgage. With resident knowledge of the best way to connect with Banks/Services nationwide, know their cost, process & time-to-complete. This helps you expedite your subordinations process by at least 60%.

With Confer, you’re not just adopting new tools — you’re embarking on a journey toward a more efficient, profitable, and risk-managed lending process.