Confer app empowers you to compare your Loan Estimate (LE) and Closing Disclosure (CD) easily, spot fee increases, and ensure you’re not overpaying for your mortgage.

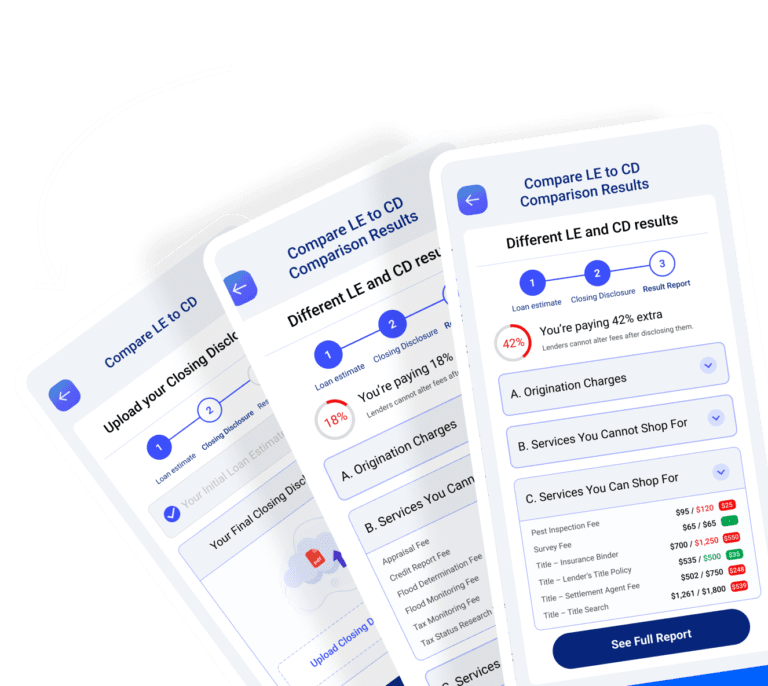

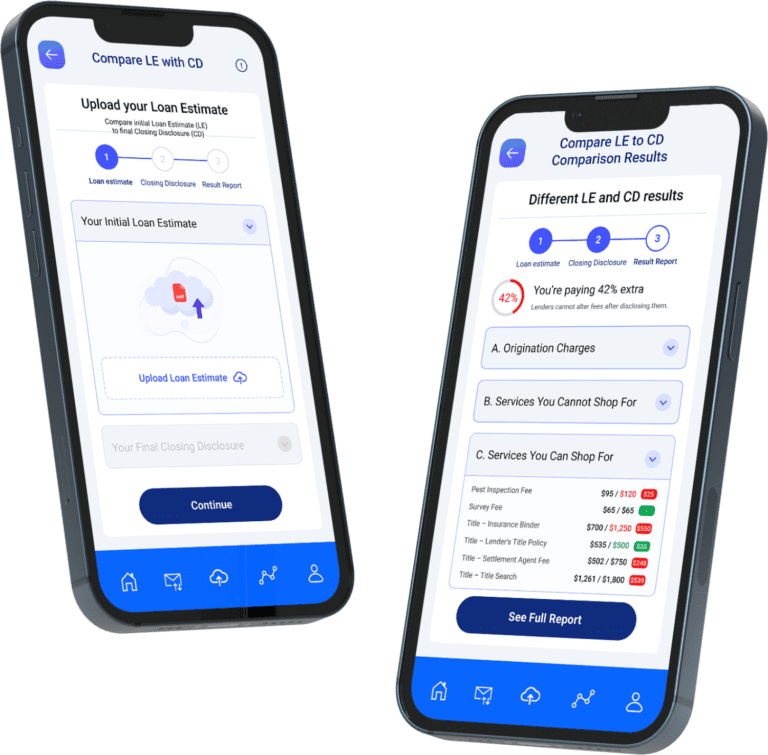

Take the first step towards smarter mortgage decisions by uploading your initial Loan Estimate (LE) and the final Closing Disclosure (CD) to our app.

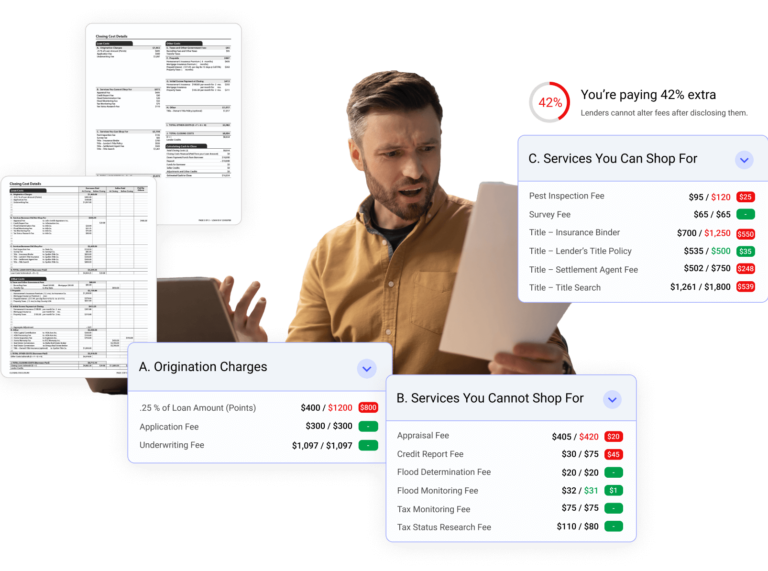

Compare your initial Loan Estimate (LE) to your final Closing Disclosure (CD) to detect any fee increases.

Enjoy peace of mind knowing our app will scrutinize your fees, identifying any increases and determining their legitimacy. You can then review the results and potentially save money on your closing costs.

Our app makes it simple to upload your Loan Estimate, Closing Disclosure and compare the results to help you save money and avoid surprises at the closing table.

Our app is your ally in the complex world of mortgages, not only detecting any fee increases but also discerning which of these changes are legitimate and which aren't. This ensures that you're not paying more than you should and that you're only covering the costs that you're responsible for.

By using our app to compare your Loan Estimate and Closing Disclosure, you can avoid the need for time-consuming and costly legal consultations. Our tool streamlines the process and helps you identify any discrepancies in a matter of minutes, saving you both time and money.

Using our app, you can ensure that you're not overpaying for closing costs and fees. This means you can maximize your savings and keep more money in your pocket. Whether you're a first-time homebuyer or a seasoned investor, our tool can help you save money and get the best deal on your mortgage.

Keep more of your hard-earned money with the Confer Today app. We arm you with the information you need to avoid surprise fees and unexpected expenses at the closing table.

Don’t wait! Download the Confer app today and start protecting your finances. Our app is available on the Apple App Store and Google Play Store so that you can get started on a secure platform with just a few clicks.