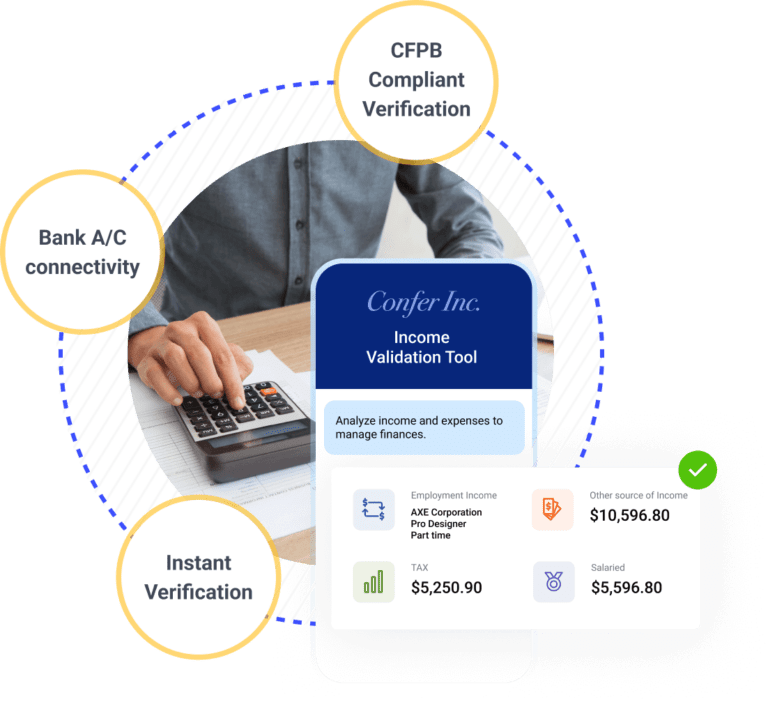

Our cloud-based service uses advanced machine learning algorithms to streamline income verification, increase efficiency, and reduce fraud in the mortgage lending process. We help mortgage lenders expedite their operations, improve accuracy, and safeguard against income fraud. Experience how our AI-driven solution can revolutionize your income validation process, making it quicker, more reliable, and robust against potential fraud.

Utilize machine learning to automate the process of income verification, significantly reducing the time and effort required in manual checks.

Our advanced algorithms analyze income documents in depth, cross-referencing with a wide range of data sources and industry benchmarks. This allows for an incredibly detailed and accurate income validation.

Detect and prevent income fraud before it affects your business. Our service spots discrepancies and irregularities early, helping to safeguard your operations.

Easily integrate our service with your existing LOS for a seamless income validation process.

Tailor the verification process to suit your specific needs. Our service allows you to adjust filters for different loan types and monitor the effects in real-time.

Don't let income validation slow you down. Our service provides income verification results in minutes, enabling you to make quick and informed lending decisions.

benefits and standout features of your service

Our Income Validation Service leverages advanced algorithms and machine learning to provide swift and accurate income verification. Here’s how it streamlines your income validation process:

Upload or Connect Borrower Income Documentation: The first step in the income verification process involves uploading or connecting borrower income documentation. The tool is designed to integrate seamlessly with your existing Loan Origination System (LOS). This feature allows you to upload or connect income documents securely and conveniently, making the process of inputting necessary data for income verification simple and efficient1.

Automated Analysis: The service employs advanced algorithms for the automated analysis of the uploaded income documents. It cross-references the data from these documents with a wide range of other data sources and industry benchmarks. To validate the income information, the tool extracts data from the internet, social media, and public records, ensuring a high level of precision and reliability in its results2.

Customizable Verification Methods: The service provides a range of verification methods that you can customize according to your specific use case and borrower profile. It allows you to adjust filters for different loan types and monitor the effects in real-time. This feature provides you with greater flexibility and control over the income verification process, enabling you to tailor the process to specific needs and scenarios3.

Deliver a seamless, personalized experience to your customers with our innovative income validation service, fostering satisfaction and loyalty.

Streamline your processes, increase your efficiency, and gain convenience and control with our solution.

Improve your operational efficiency through automation, data analytics, or process optimization with our tools and expertise.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy t

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Our Income Validation Service leverages advanced algorithms and machine learning to provide swift and accurate income verification. Here’s how it works:

Integration with Your LOS: Our tool integrates seamlessly with your existing Loan Origination System (LOS), allowing you to upload or connect borrower income documents securely and conveniently.

Automated Analysis: Our service analyzes income documents, comparing them to a wide range of data sources and industry benchmarks. It cross-references information from the internet, social media, and public records to ensure precision and reliability.

Customizable Verification: Tailor the verification process to your specific use case and borrower profile. Our tool allows you to adjust filters for different loan types and monitor the effects in real-time.

Fast Results: With our service, income verification results are available in minutes, enabling you to make lending decisions swiftly and confidently

Experience the efficiency and accuracy of our Income Validation Service at competitive rates. We offer flexible pricing options tailored to fit your business needs:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus,

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text. Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text. Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text.

Our service is unique due to its advanced use of machine learning and AI algorithms, comprehensive fraud detection capabilities, and customizable verification methods. It integrates seamlessly with your Loan Origination Systems (LOS), making it a complete solution for income validation in the mortgage lending process

We prioritize data security and privacy. Our platform uses industry-standard encryption methods to protect your data and complies with relevant privacy laws and regulations. Rest assured, your sensitive borrower information is in safe hands.

Yes, our service is designed to integrate smoothly with commonly used Loan Origination Systems (LOS), providing a streamlined user experience.

Our tool is built for speed! Get verification results within minutes, enabling faster lending decisions.

We provide comprehensive customer support for any issues or queries you might have. Our team of experts is always ready to help you get the most out of our service.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.