In a high-stake mortgage landscape, Confer is your secret weapon. Our AI tirelessly combs the web, securing you the best mortgage deals. No more guesswork, just tailored solutions.

Experience the ease of AI-powered efficiency, end-to-end assistance, and personalized mortgage solutions. With Confer, you’re not just getting a mortgage—you’re investing in peace of mind.

Don't let high rates intimidate you. Our AI-driven system simplifies the mortgage process, empowering you with knowledge and strategic guidance.

In a high-rate market, every penny counts. Our optimized mortgage process minimizes paperwork and negotiation, saving you valuable time and potentially thousands of dollars.

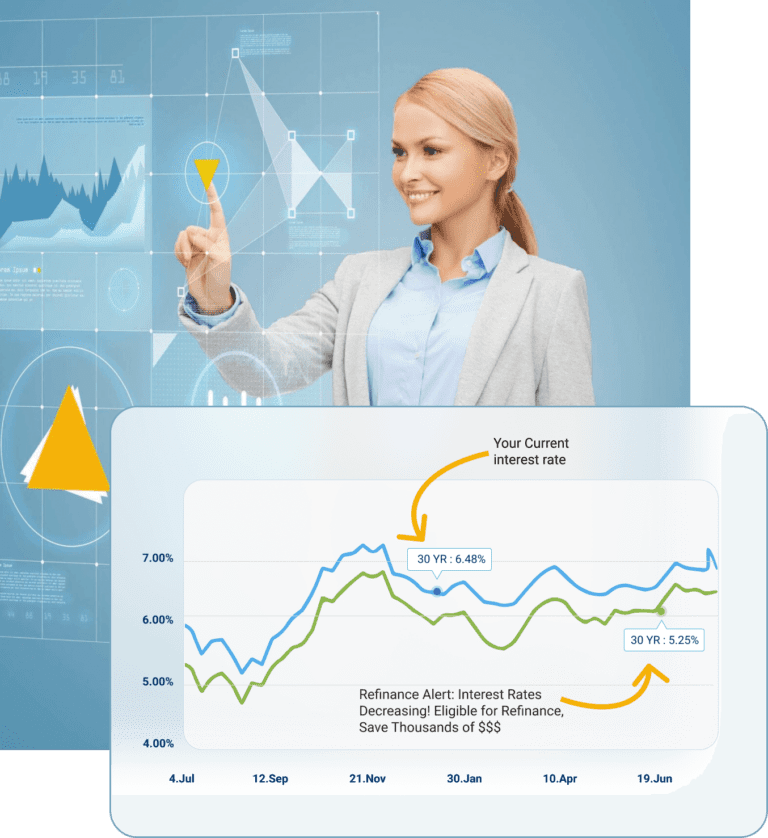

We leverage AI to analyze your financial situation and the current mortgage climate, delivering the best mortgage options tailored specifically for you.

We provide an in-depth review of your documents, such as the Loan Estimate (LE) and Closing Disclosure (CD), to ensure nothing slips through the cracks.

Your data is safe with us. We adhere to high security standards to ensure your personal information is protected.

Our dedicated support team is available 24/7 to assist you in this high-stakes journey.

At Confer, we’ve designed our services to withstand even the toughest mortgage climates. We combine advanced AI and Machine Learning technologies with a dedicated team of professionals to deliver personalized mortgage solutions. We’re dedicated to simplifying the mortgage process, saving you time, money, and stress—even in high-rate environments.

We believe in:

Our process is specifically designed to help you navigate through high-interest-rate environments.

Step 1

We start by gaining a thorough understanding of your unique financial situation and mortgage needs.

Step 2

Step 3

Step 4

Our team is available around the clock to provide any assistance you might need.

We understand that mortgages can be complex and overwhelming. That's why we're dedicated to making your mortgage journey as simple and stress-free as possible. From personalized guidance to end-to-end assistance, we're with you every step of the way.

Leverage the power of AI and Machine Learning with Confer Concierge. Our advanced technologies drive efficiency and precision in the mortgage process, saving you time and avoiding potential pitfalls. With Confer, you get the perfect blend of human expertise and technological innovation.

With Confer Concierge, you don't just get a mortgage – you get the best mortgage for you. Our AI-powered platform analyzes thousands of options to find the most financially advantageous ones for your specific situation. We also review your Loan Estimates and Closing Disclosures, ensuring you're not overpaying.

At Confer Concierge, we’re proud of our advanced AI and ML technology – but we believe it’s better seen in action. That’s why we offer a detailed prototype demo showcasing our system’s power and efficiency.

Here’s what you can expect to see:

Witness how our AI crafts bespoke mortgage advice tailored to individual financial situations.

Understand the thoroughness of our document review process, including Loan Estimates (LE) and Closing Disclosures (CD).

See how our system analyzes an extensive range of mortgage options to identify the ones that best suit your needs.

Experience the ease of having 24/7 assistance at your fingertips.

Getting started with Confer is both easy and straightforward. Here’s what the process looks like:

At Confer Concierge, we believe in transparency and value for money. We charge a flat rate of $99 per month for our services. This includes access to our AI-powered mortgage analysis, expert document review, and 24/7 customer support. There are no hidden costs or additional fees. By simplifying the mortgage process and potentially saving you thousands on your mortgage, we ensure that our services offer excellent value.

Our mission at Confer Concierge is not just to help you secure a mortgage, but to ensure you get the best possible deal.

Getting started with Confer is easy and straightforward. Here’s how it works:

We start by getting to know you. Our team takes the time to understand your unique financial situation and mortgage needs. This personalized approach ensures we can provide the most suitable and strategic mortgage options for you.

Our advanced AI system comes into play here. It sifts through a multitude of mortgage options, analyzing and identifying the ones best tailored to your needs. This technology-driven process is efficient, precise, and designed to save you time.

Accuracy and thoroughness are crucial when it comes to your mortgage documents. We conduct an in-depth review of key documents such as Loan Estimates (LE) and Closing Disclosures (CD), ensuring every detail is accurate and nothing slips through the cracks.

Our support extends beyond just obtaining a mortgage. If you need help with other aspects of the mortgage process, such as finding title, escrow, and closing services, or even a different lender, we’re here to assist. We’re with you every step of the way, offering a comprehensive, one-stop solution for all your mortgage needs.

When it comes to handling your sensitive financial data, we at Confer take no chances. We understand the gravity of the trust you place in us, and we’re committed to maintaining and honoring that trust by providing superior security and trusted protection.

Here are some frequently asked questions:

No, the Confer App is 100% free to use. There are no ads, no subscriptions, and no hidden costs to the borrower.

Our dedicated support team is available around the clock to assist you with any questions or concerns. We’re with you every step of the way, from initial analysis to final closing.

Welcome to a new era of mortgage solutions. With Confer, you gain access to an innovative, AI-driven platform that simplifies your mortgage journey. Our system is designed to provide you with personalized mortgage deals that align with your unique needs and preferences.

Say goodbye to the stress and uncertainty of traditional mortgage hunting. Confer’s AI service transforms the process into a seamless, efficient experience. It’s not just about getting a mortgage—it’s about securing the best mortgage for your future.

Confer is more than a service—it’s your partner in navigating the complex landscape of mortgages. Begin your journey with us today.